2024 Financial Wellness Series

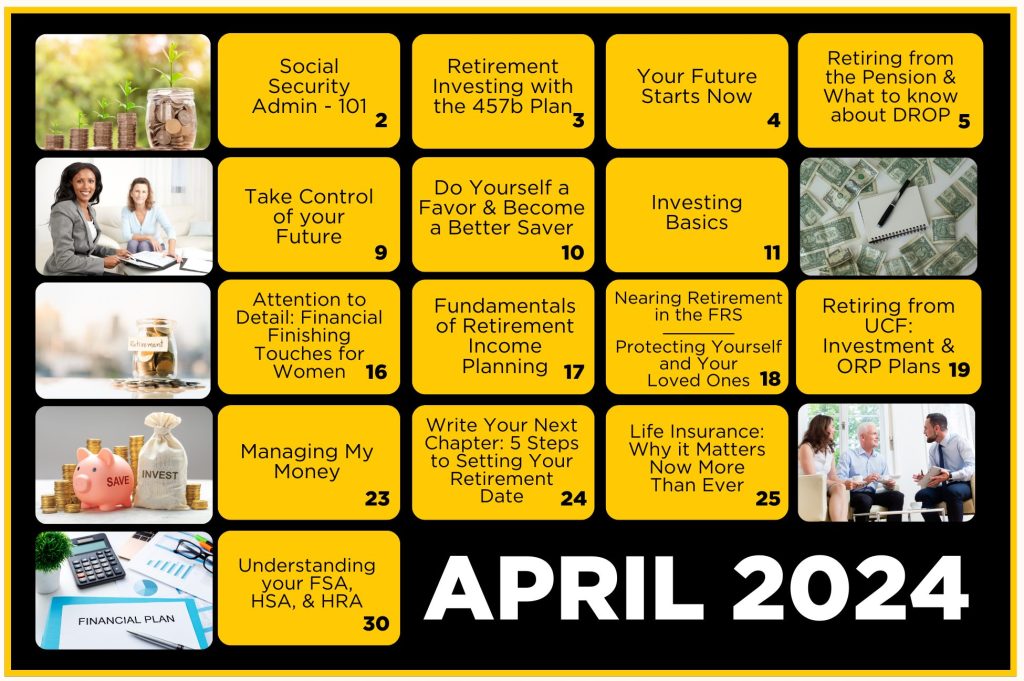

The Financial Wellness Series is a month-long event held on select dates between April 2, 2024 and April 30, 2024 where the UCF HR Benefits section hosts a series of workshops, presentations, and webinars designed to provide UCF employees with practical tools and resources to build their financial knowledge and future.

For session descriptions, click on the calendar to view the brochure.

Registration

To register for courses and get more course information, follow the instructions below:

-

Go to workday.ucf.edu and sign in with your NID credentials

-

In the search bar at the top of the Workday screen, type “Browse Learning Content” and select “Browse Learning Content” from the search results.

-

Search for the course by entering the course number or course name in the catalog search bar; you can narrow the search by using the filters on the left side of the screen.

-

Select the desired course and click “Enroll.”

-

On the next screens, click “Submit” and “Done.”

- On the next screen, click “Add to Calendar.”

CAPTRUST individual meetings have a separate registration link found on the Financial Wellness Series Brochure and does not require enrollment through Workday.

Materials

Electronic course materials will be added after each session.

On-Demand Webinars

There are several pre-recorded webinars available through the following resources, which can be viewed at any time during the month of April.

Corebridge Financial (formerly VALIC/AIG)

Get help on planning for your current and future needs. These webinars cover the many different aspects of financial planning, including cash management, investment planning, risk management and retirement planning. Upcoming and on-demand webinars can be viewed online.

Deferred Compensation (457 Accounts)

UCF offers multiple voluntary savings plans to assist you in planning for your retirement. One way to meet long-term financial goals is to participate in a tax-deferred 457(b) plan. Learn more about this deferred compensation plan.

Fidelity

Learn from financial experts on how to establish your financial foundation, save for a rainy day, manage your debt, and control your spending. On-demand and upcoming live webcasts are available online. Registration may be required.

Florida Retirement System (FRS)

The FRS offers several webinars on various topics. You can view upcoming webinars on the FRS Calendar.

TIAA

Hear from TIAA financial leaders who explore a broad range of topics that directly impact your financial planning. Registration may be required to access the webinars.

Did You Know?!

- UCF makes employer contributions to FRS and SUSORP retirement plans?!

- Employees can voluntarily contribute up to $23,000 to a 403b and another $23,000 to a 457 in the same year. If age 50 or older you can contribute more!

- Pretax contributions towards retirement lowers your overall taxable liability.

- Employees can take loans and hardship withdrawals from their 403b or 457 accounts, when eligible.

- The standard Medicare Part B monthly premium amount for 2024 is $164.90.

- UCF pays between $700-1800 a month for each employee enrolled in the state health insurance plans.

- Under the Shared Savings Program, you can earn rewards by receiving rewardable healthcare services through the use of the state’s new vendors, Healthcare Bluebook and SurgeryPlus.

Other Ways to Save

Abenity

UCF employees receive discounts from an elite collection of local and national hotels, car rentals, florists, theme parks, national attractions, movie theaters, restaurants, retailers, concerts & more through Abenity. Discounts are online, over the phone, in-store or through printable and mobile coupons. Visit Abenity’s website for more information.

Florida Prepaid College Plan

The University of Central Florida supports employee participation in the Florida Pre-Paid College Plan by offering payroll deductions to cover premiums each month. The plan allows you to select from options with specific costs, payment schedules and benefits. Plans include two year, four year, and dormitory options. For more information, visit the FL Prepaid website.

Health Advocate

The Employee Assistance Program (EAP) is a university-funded benefit that offers multiple benefits, including financial resources. Through the EAP, employees have access to estate planning and paying for college webinars; car loan, mortgage, and debt relief calculators; budgeting, wills, and tax forms; and telephone consultations with financial and legal specialists. For more information, call 877-240-6863 or visit the Health Advocate website.

LinkedIn Learning

LinkedIn Learning is a leading online learning platform that helps anyone learn business, software, technology, and creative skills to achieve personal and professional goals. Explore over 12,000 courses and 5,000 video tutorials from industry experts and leaders all in one place. LinkedIn Learning is available to all UCF students, faculty, and staff. For more information, visit the Linkedin Learning website.

SGA Ticket Center

The SGA Ticket Center offers specially priced tickets to various local theme parks, attractions, movie theaters, and transportation providers. Tickets are intended for use only by UCF students, staff, and faculty. For more information, call 407-823-2816 or visit the SGA Ticket Center website.

Technology Product Center

The Technology Product Center (TPC) offers various academic discounts on hardware and software. For additional information, visit UCF Technology Product Center or call 407-823-5603.

Tuition Waiver Program

The University offers tuition assistance to eligible employees in the form of tuition waivers, good for up to six credit hours of coursework per semester. Eligible employees include A&P, Executive Service, USPS and Faculty, and courses are restricted to those taken at UCF. Contact the UCF Student Accounts department (407-823-2433) or visit the UCF Tuition Waiver website for additional information.